rhode island income tax rate 2020

Tax rate of 475 on taxable income between 68201 and 155050. How to Calculate 2020 Rhode Island State Income Tax by Using State Income Tax Table.

Tax rate of 375 on the first 68200 of taxable income.

. Rhode Island has a flat corporate income tax rate of 7000 of gross income. DLT also announced that the 2021 Temporary. Your average tax rate is 1198 and your marginal tax.

Single Tax Brackets Married Filing Jointly Tax Brackets For earnings between 000 and 6525000 youll pay 375 For earnings between 6525000 and 14835000 youll pay 475 plus 244688 For earnings over 14835000 youll pay 599 plus 639413. Rhode Islands income tax brackets were last changed one year prior to 2020 for tax year 2019 and the tax rates were previously changed in 2009. Interest on overpayments for the calendar year 2020 shall be at the rate of five percent 500 per annum.

Ad Download Or Email RI-1040NR More Fillable Forms Register and Subscribe Now. For the Single Married Filing Jointly Married Filing Separately and Head of Household filing statuses the RI tax rates and the number of tax brackets remain the same. 2020 The interest rate on delinquent tax payments has been set at eighteen percent 18 per annum.

Check the 2020 Rhode Island state tax rate and the rules to calculate state income tax. Rhode Island Tax Brackets for Tax Year 2020 Tax Rate Income Range Taxes Due 375 0 to 65250 375 of Income 475 65250 to 148350 244688 475 599 148350 639413 599 over 148350. Rhode Island Income Tax Calculator How To Use This Calculator You can use our free Rhode Island income tax calculator to get a good estimate of what your tax liability will be come April.

The average effective property tax rate in Rhode Island is the 10th-highest in the country though. Any earnings above 147000 are exempt from Social Security Tax. 66200 150550 375 b Multiplication Taxable Income line 7 TAX RATES APPLICABLE TO ALL FILING STATUS TYPES 475 599 c Multiply a by b d Subtraction amount 000 66200 252882 RHODE ISLAND TAX COMPUTATION WORKSHEET a Enter the amount from RI-1040 line 7 or RI-1040NR line 7 Amount 25200 25250 946 25250 25300 948.

Rhode Island also has a 700 percent corporate income tax rate. TDI tax at a glance 2020 2021 Tax rate 13 13 Taxable wage base 72300 74000 Maximum tax 93990 96200. However as a result of legislation approved by the Rhode Island General.

Tax Schedule F with rates ranging from 09 percent to 94 percent was in effect in calendar year 2020. Tax rate of 599 on taxable income over 155050. Tax Year Status Amount 2020.

Withhold 62 of each employees taxable wages up until they reach total earnings of 147000 for 2022. The federal corporate income tax by contrast has a marginal bracketed corporate income taxThere are a total of twenty four states with higher marginal corporate income tax rates then Rhode Island. Find your pretax deductions including 401K flexible account contributions.

2020 Tax Rate Schedule - FOR ALL FILING STATUS TYPES Taxable Income from RI-1040 or RI-1040NR line 7 Over 0 65250 But not over Pay of the amount over 244688 375 475 on excess 0 65250 14835065250 148350 639413 599148350 Page i. Rhode Island has a graduated individual income tax with rates ranging from 375 percent to 599 percent. Rhode Island Income Tax Table Learn how marginal tax brackets work 2.

As an employer you will also need to pay this tax by matching your employees tax liability dollar-for-dollar. The rate so set will be in effect for the calendar year 2020. If you make 70000 a year living in the region of Rhode Island USA you will be taxed 11081.

Tax Rate 0. This means that these brackets applied to all income earned in 2019 and the tax return that uses these tax rates was due in April 2020. Social Security Tax.

Find your gross income. Rhode Island has a 700 percent state sales tax rate and does not levy local sales taxes. The Rhode Island State Tax Tables below are a snapshot of the tax rates and thresholds in Rhode Island they are not an exhaustive list of all tax laws rates and legislation for the full list of tax rates laws and allowances please see the Rhode Island Department of Revenue website.

Ad Calculate your federal income tax bill in a few steps. In order to be eligible for the Child Tax Rebate please remember to file your tax year 2021 Personal Income Tax Return by August 31 2022 or if you have. The average family pays 78800 in Rhode Island income taxes.

Rhode Island Income Tax Rate 2022 - 2023. Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump. The chart below breaks down the Rhode Island tax brackets using this model.

Find your income exemptions. The UI taxable wage base will be 24600 for most employers and 26100 for employers at the highest rate. If your taxable income is larger than 100000 use the Rhode Island Tax Computation Worksheet located on page T-1.

2020 Rhode Island Tax Deduction Amounts. In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per child up to a maximum of three children maximum 750. 2021 Rhode Island Standard Deductions The Rhode Island standard deductions has increased for Tax Year 2021.

The state does tax Social Security benefits. Rhode Islands tax system ranks 40th overall on our 2022 State Business Tax Climate. A simplified Tax Calculator for HOH Single and Married filing Jointly or Separate.

By law the UI taxable wage base represents 465 of the average annual wage in Rhode Island. Household income location filing status and number of personal exemptions. Ad Download Or Email RI-1040NR More Fillable Forms Register and Subscribe Now.

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

Visualizing Unequal State Tax Burdens Across Maps On The Web State Tax Finance Function Tax

Rhode Island Income Tax Calculator Smartasset

Rhode Island Income Tax Calculator Smartasset

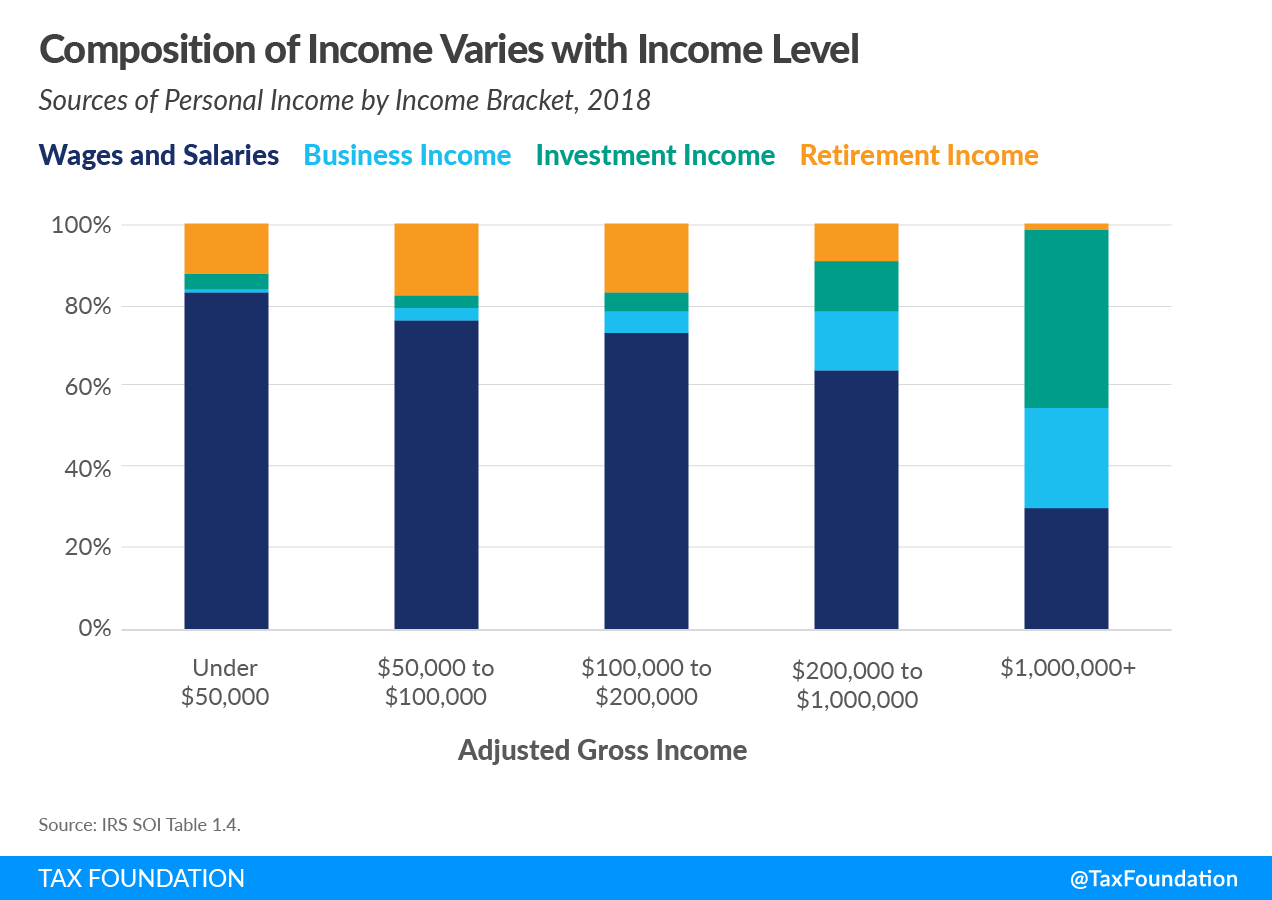

Sources Of Personal Income In The United States Tax Foundation

Rhode Island Tax Rates Rankings Ri State Taxes Tax Foundation

State Income Tax Rates Highest Lowest 2021 Changes

State Corporate Income Tax Rates And Brackets Tax Foundation

Sources Of Personal Income In The United States Tax Foundation

How Do State And Local Sales Taxes Work Tax Policy Center

Cargo Shipped By Shanghai Express Freight Trains Crosses 1 Bn Yuan In 2022 Cargo Shipping Shanghai Train Service

Prenuptial And Postnuptial Agreements In Florida Bickman Law Prenuptial Agreement Prenuptial Divorce Law